There once was a website, with 50 million unique visitors per day. Hosting 12 billion files, it was the 13th most visited site on the internet, accounting for 4% of all internet traffic. Do you know what site I’m talking about?

It’s not Google, nor is it Yahoo or YouTube; in fact, it’s none of the large established businesses you would expect it to be. Have you guessed the answer yet? It’s the money laundering, racketeering, copyright infringing site everyone used to know and love: Megauploads.

Megauploads were once an established business dominating the cloud computing service’s industry. It was legitimate, had global recognition and overwhelming success, being endorsed by prominent artists such as Kanye West, Puff daddy, Snoop Dog and many more.

Megauploads generated over $175 million in profits over 7 years of operation, but this came at the ultimate price, 500 million in damages and 7 arrests. So how did this seemingly legitimate business accounting for 4% of all internet traffic one day become the nefarious culprit responsible for illegal activity? Where was the regulation to stop this? Why had it failed to stop this disaster?

Megauploads were deemed responsible for allowing mass copyright infringement, but doesn’t YouTube do the exact same thing? How did one site land on the wrong side of the law whilst the other still legitimately operates today?

This example raises interesting parallels towards bitcoin, seemingly everyone is waiting for bitcoin regulation like it will determine its future in a very profound way. But what exactly can regulation actually provide for bitcoin?

Regulation is “A rule or directive made and maintained by an authority”, it’s not law, it’s ‘guidelines’ which provide a code of practice. Regulation does not change the legality of something nor the consequences of non-compliance, ‘ignorance of the law is not is not an excuse’, nor is regulation.

##The current state of Bitcoin regulation

One thing that needs to be distinguished is the difference between the regulation of ‘Bitcoin the protocol’ vs. the regulation of ‘bitcoin companies’. For Bitcoin the protocol, it represents a new paradigm within finance, regulators are unsure about how to classify it; trying to label bitcoin with any pre-existing definition represents a complete lack of understanding.

[Bitcoin appears to be a decentralized account based payment system without an issuer or central counterparty. It involves the circulation of valuable rights but not rights to cash as such. The valuable rights are a form of intangible property, transferred irrevocably and immediately (albeit with delayed confirmation) by electronic order.

- Rhys Bollen, Monash University.](http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2285247)

Currently there is a lack of consensus about what bitcoin even is! Each country has its own interpretation, leading to an ambiguous regulatory environment for Bitcoin.

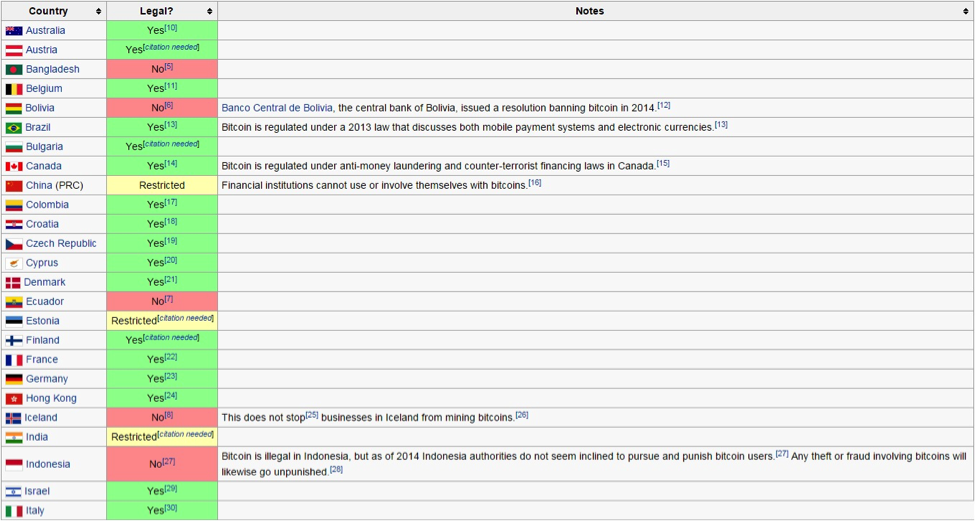

As you can see from Wikipedia’s Legality of bitcoin by country (screenshot below), different countries have incredibly different interpretations of ‘what is bitcoin’. If countries can’t even agree upon a definition of bitcoin, what benefit can we really expect from regulation?

But separate from ‘Bitcoin the protocol’, surly there’s benefit in clarifying AML/KYC regulations for ‘bitcoin companies’? Clear and concise rules for such matters will promote and establish a healthy industry, free of hiccups like MT GOX.

One of the best case studies of this is The Isle of Man. Which has not only released its regulation for Bitcoin Business, but also has an existing permissive financial and gambling regulation.

Any Bitcoin related business in the Isle of Man has to comply with existing AML requirements, collecting ID information and assisting to identify suspects of money laundering. Businesses also have to register with, and be overseen by the Financial Services Committee (FSC). This approach is not necessarily good for Bitcoin; it boxes it in with existing financial instruments and gives poor insight into other use cases.

[The extra hassles/costs will put many startups off and seems unnecessary”…“I can’t help feeling it will have every major scam in crypto all over the world looking to come to the island in order to get a license as well.

- Adrian Forbes, co-founder of TGBEX](http://www.coindesk.com/isle-of-man-introduces-regulation-for-bitcoin-businesses/)

This supposedly ‘game changing’ regulation from the Isle of Man known for its permissive regulation has resulted in two things:

- Higher cost of entry for startups.

- Stricter KYC information collection requirements, lowering the minimum reporting requirement from €12 000 to €1000.

So what exactly has this regulation provided except raising the barrier to entry?

Alternatively, countries such as Canada and Australia have refrained from releasing any official regulation, viewing Bitcoin as an entity of too small size to be worthy of specific regulation. This decision was made to prevent stifling innovation during bitcoin’s infancy.

Other countries like Russia and Ecuador have outlawed this new technology all together, preventing business or even individuals from participating in this new industry. This type of ‘regulation’ effectively makes using bitcoin illegal but not impossible; as long as the internet is accessible bitcoins can be transferred.

Another great example of regulation and bitcoin is the Bitliscence, New York’s Department of Financial Service’s (NYDFS) answer to these regulatory ambiguities. The cost of the license starts at $5,000 USD.

The license requires: the name, address, personal history and fingerprints of ‘key employees’, submission of written plans describing any new products or services as well as material changes to existing offerings, valid for two years and subject to review. Any business which exchanges fiat currency for virtual currency will require a license.

[The framework [BitLiscence] now indicates that digital currency businesses will need to keep “a general ledger containing all asset, liability, ownership equity, income and expense accounts”, as well as identifying information for “any parties to the transaction” in addition to the names, account numbers and physical addresses of all those involved.

- Coindesk](http://www.coindesk.com/breaking-down-new-york-bitlicense-revision/)

These types of regulatory requirements are double edged. As they try to promote the growth of bitcoin through safe practice, but they simultaneously raise the barrier to entry and stifle the innovative potential. Is this really what bitcoin needs to succeed? I doubt that collecting information on the owners of bitcoin companies and their employees (which have access to funds) will affect the probability of malpractice.

Recently Ripple Labs (San Fransisco, CA) was fined $700,000 recently for failing to register with FinCEN as a money service business and failing to implement an adequate anti-money laundering program.

- FinCEN

This perfectly highlights the problem with existing regulation aimed at bitcoin business. It uses an umbrella approach towards bitcoin business, viewing it as a financial tool and missing the larger point. Focusing on the smaller risk of money laundering will not prevent another huge loss of funds through poor practice (MT GOX).

Bitcoin is not foremost a financial instrument, it is a technology. Focusing on bitcoin as a financial instrument is ‘not seeing the forest from the trees’, any type of AML/KYC centric regulation fails to address the real problem, the $700 million of consumer fund losses. It shouldn’t be focusing on money laundering; it should be focusing on safe ‘bitcoin business’ practice.

##Bitcoin and Regulation: What it should be addressing

###Security Guidelines

What would benefit bitcoin and its related companies would be code of practice towards securely storing bitcoins. Although bitcoin the protocol is inherently safe, USD $700 million worth of Bitcoin has been lost or stolen, the majority of which has been the result of poor security measures (MT GOX is responsible for $450 million in losses alone). The method each bitcoin company uses to store bitcoins is entirely arbitrary, without regulation addressing this specific point, there’s no way to tell who has your funds and who is just pretending. This is the number one issue that Regulators should be addressing.

Bitcoin as a money transmission vehicle

This point seems to be covered by all regulatory guidelines so far. The majority of regulation already released covers this topic, specifically AMC/KYC requirements. All bitcoin exchange transactions involve similar practices to opening a bank account.

This type of regulation should not be so draconic; after all, bitcoin is not only used as a payment vehicle. Defining regulation to specifically address the laundering of money should not be a major concern in any case; after all, any business which effectively promotes this type of conduct will be fined and shut down by law enforcement agencies. Not to mention there is no incentive for ‘terrorists’ to use bitcoin over fiat currencies, it’s much more traceable and harder to exchange than cash.

Bitcoin Taxation requirements

Bitcoin needs to be viewed as a foreign currency; this decision has issues due to existing laws defining a currency to need government backing. These types of opinions have resulted in bitcoin being viewed as “goods” subject to 10% tax in certain countries. This type of regulatory decision demonstrates trying to fit bitcoin into existing definitions, something which ultimately will not work.

###Smart Contracts

The conditions of smart contracts and their legal precedences is a major issue lying underneath the surface of bitcoin. One of the largest areas for innovative potential within bitcoin is smart contracts, but there is little discussion about whether a smart contract is legally binding. This area needs addressing immediately, as delays will heighten the probability of future issues much greater than anything we have seen so far. To what degree will the law recognize smart contracts as being legally binding, this is the iceberg of bitcoin regulation.

###Blockchain

The final area that needs regulatory discussion is the Blockchain. The Distributed consensus ledger needs to be understood as an entity not specific for financial transactions or permissible to control. This type of instrument is a new concept to the world, the sooner governments articulate their recognition of its existence and implications the sooner bitcoin will develop.

These concepts may seem abstract, but these are the questions that need discussion now, they are pertinent to bitcoins success. Waiting another 12 months to determine whether John Doe needs to provide a copy of his identification for a $500 purchase is another 12 months spent in vein. It will provide nothing beneficial to the users nor prevent any major future problems.

###Self-Regulation and the Blockchain

Can regulators really help bitcoin? The regulators know less about bitcoin than the people within the industry. Can we actually expect any decision to be beneficial for the future of Bitcoin as a technology? I believe that bitcoin could be effectively self-regulated, as market forces will ultimately decide what is successful.

Bitcoin is still in the ‘wild-west’, there are varying levels of ‘regulation’ being implemented by companies in different countries. I believe that the people who own these businesses are effectively better equipped at making decision regarding best practice than any regulators. Just watch this video if you don’t believe me:

This is ultimately what bitcoin needs at this point in time, it has to cease believing in an oversight committee as being capable of giving it the support and encouragement it requires, they lack the understanding of what bitcoin is to offer that kind of meaningful supervision. Even with regulation you will still see malpractice, fines, and closures.

As we have seen in other industries, businesses will come and go, survival is not a guarantee. Ultimately, who survives is determined by a free market. Regulation will aim to cease bad conduct but will not change a thing; it can only address a problem in retrospect.

As we saw with Megauploads, a business always complies with the law until the law stops complying with the business. Regulation is not going to change a thing in bitcoin; it’s up to its users to be responsible, but then again, who would you rather trust with its future?